Exness Professional Accounts

Exness Pro Accounts are types of accounts used for the skillful and experienced trader looking for advanced features. Pro accounts offer Raw Spread, Zero – spread free option, Pro – bigger trading volume with a decreased spread combined with higher leverage to help realize better trading conditions. Suitable for the traders who take their trading into the other level already: prompt execution, access to any market, from Forex to metals and cryptocurrencies, for a trader to have everything he needs both by tools and by conditions.

Types of Exness Professional Accounts

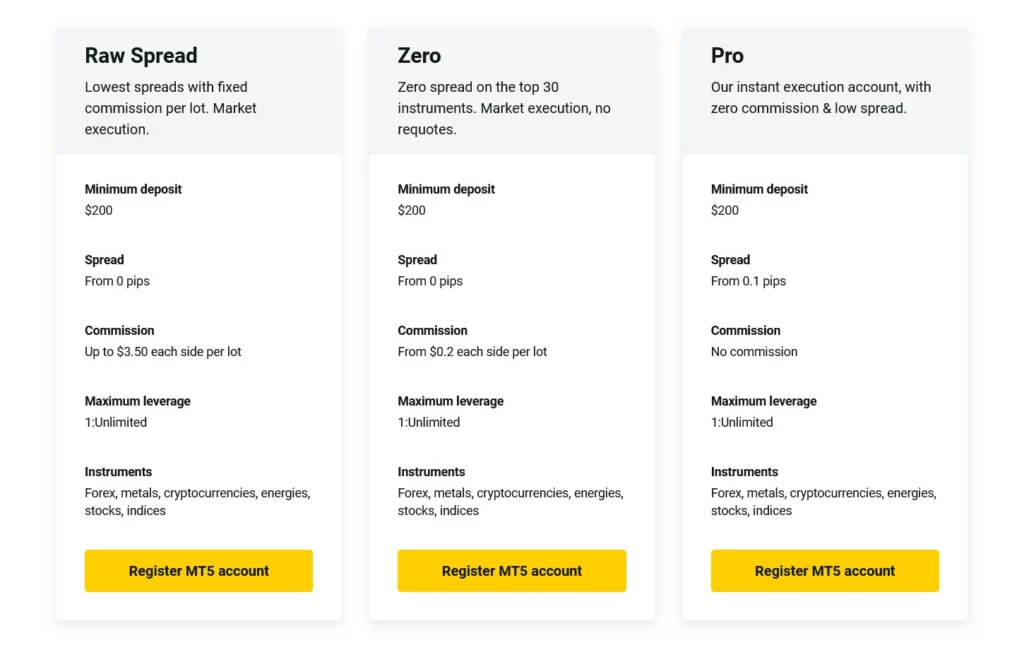

Exness offers three types of professional accounts designed for the most serious traders: Raw Spread, Zero, Pro. Each account is meant for different needs in trading. While Raw Spread accounts are ideal for those who seek ultra-low spreads and at the same time the lowest fees on transactions. The Zero Spread accounts play a very crucial role in times that you need a zero spread to execute some trades, hence making cost calculations more flexible. Pro Account is the commission-free balance that has more predictable costs and is meant for clients who trade in higher volumes. All these accounts give the trader the possibility of accessing major markets such as Forex, metals, and cryptocurrencies and executing capabilities of trading execution efficiently. Designed for those traders who are ready to take their trade to an advanced level, this account offers advanced trading with outstanding trading conditions.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Exness Raw Spread Account

Exness Raw Spread Account is designed for traders who aim to cut costs with very low spreads and a small commission fee. This account with market execution and initial low spreads from 0.0 pips. The minimum deposit for this account is $200.

It’s perfect for quick trades and offers direct market prices across various instruments. The commission charged per side is up to $3.50 per lot for the account. This type of account poses very attractive leverage of 1:unlimited. An account of this sort can trade and deal with assets like forex, metals, energies, shares, and indices.

Exness Zero Account

Zero Professional Account offers traders a way to save on costs with zero spreads on major currency pairs and minimal commission fees, and besides, metals, energies, stocks, and indices are also tradable. The amount required for the minimum deposit equals that stipulated for the Raw Spread account.

The differentiator here is the commission. The Zero account has a much lower commission, starting at just $0.2 per side per lot. And also, the difference in spread is huge too, starting from 0.0 pips (zero spread). The leverage can reach up to 1:unlimited.

Exness Pro Account

Exness Pro Account is an instant execution. The same minimum deposit and kinds of assets. The Pro Account, on the other hand, has no commissions on any trade and allows one to enjoy very low spreads starting at just 0.1. It covers a wide range of markets like forex, metals, and cryptocurrencies, perfect for those looking to trade with precision and without extra costs. All Exness professional accounts are available as swap-free, and the lot size of all is 0.01 minimum.

Over 2 million people worldwide have chosen a global leader in online financial trading & investment.

Benefits of Choosing an Exness Professional Account

Exness Professional Account allows free choice of the instrument presented to trade with the highest leverage and low margin requirements. Without restrictions of leverage, maximum capital can be allocated, while traders earn extra profits even in the situation where underlying financial instruments in the market undergo marginal changes in prices. Basically, leverage is only meant to magnify the amount of available capital for a trader with this kind of account and consequently allow one to fully capitalize on trading opportunities availed by the market. Professional traders are supplied with the leverage that is necessary for them to make full gains from trading capital through lower margin requirements. In most cases, on an average, the margin requirements of retail trading accounts are set at 50%, offering a limitation on the activities by a trader.

The margin requirements on the Exness Professional account are significantly relaxed against different classes of assets, hence giving the trader the motivation needed to make the most of their trading capital. The reason inherent risk comes with using a higher leverage ratio is that the professional traders are expected to be experienced and best positioned for the management of the inherent risk. When it actually becomes rather a tempting possibility to use an Exness Professional account, it is as important to make the choice with sound knowledge of the various factors that would come to play. The account type has benefits to the holder but is distinct and implies careful handling. This is a systematic explanation for the potential advantages and disadvantages one may face while operating an Exness Professional Account.

Exness Pro Accounts vs. Standard Accounts

The choice of whether to take an Exness Pro or Standard Account depends on the experience and objectives of your trading. The Pro Account has lower spreads and high leverage. It is best suited for experienced traders looking to benefit more by capitalizing on efficient trading conditions and bigger profits. Besides, they offer a larger pool of financial instruments, including advanced forex, metals, and cryptocurrencies. Such settings are the best suited for those traders who indulge in trading activities quite frequently and/or immensely.

| Feature | Pro Accounts | Standard Accounts |

| Spreads | Lower | Higher |

| Leverage | Higher | Standard |

| Commissions | None/Low | None |

| Instruments | Broader range | Basic range |

Over 2 million people worldwide have chosen a global leader in online financial trading & investment.

Choosing the Right Exness Professional Account for You

Choosing the most suitable Exness Professional Account depends on your trading style and what you expect from your account. If you trade frequently and aim to minimize costs, the Raw Spread Account with its ultra-low spreads and minimal commissions could be perfect for you. If you want to avoid spreads on major pairs entirely, then the Zero Account might suit you better. And for those looking for a good balance of benefits without commission fees, the Pro Account provides competitive spreads and a vast selection of trading instruments.

- Raw Spread Account: Ideal for active traders who prioritize the lowest spreads and are okay with a small commission;

- Zero Account: Perfect for traders who focus on major forex pairs and prefer no spreads;

- Pro Account: Suitable for experienced traders seeking no commission fees and access to a wide market.

How Pro Accounts Benefit Different Trading Styles

| Pros Exness Pro Account | Cons Exness Pro Account |

| Tight spreads, from 0.0 pips, which can potentially lead to lower trading costs. | Unlimited leverage can multiply both gains and losses, and the losses can be enormous if not managed properly. |

| Low commissions. | Traders often need to meet specific criteria, such as trading experience, trading volume, or capital requirements. |

| Accounts normally provide faster and more professional order execution, and the professional one may reduce slippage, providing more speed of trade execution. | Can have sophisticated trading features, hence the best features to be integrated with them are trading strategies that may scare a novice or seem too much. |

| Unlimited leverage, allowing traders to control larger positions with a smaller amount of capital. | There’s no negative balance protection. |

FAQs Exness Professional Accounts

What are the minimum deposit requirements for a Pro Account?

The minimum first-time deposit for Exness Professional account types is at least USD 200, although this may vary depending on regional requirements

How do Exness Pro Accounts differ from Standard Accounts?

Exness Pro Accounts are designed for seasoned traders, providing low to zero spreads, commission-free options, and market execution. They’re ideal for scalpers, day-traders, and algo traders, offering benefits such as instant execution and leverage up to 1:Unlimited across a diverse range of trading instruments like Forex, metals, and cryptocurrencies

Am I eligible to open an Exness Professional Account?

Eligibility for an Exness Professional Account hinges on your trading experience, volume, and financial standing. Aimed at seasoned traders, these accounts demand an in-depth understanding of forex and CFD markets, as well as the capability to handle the risks of increased leverage

What are the risks associated with higher leverage in Pro Accounts?

Higher leverage on Pro accounts increases potential gains and losses, allowing you to make larger trades with less capital, but increasing risk, especially in volatile markets. Before engaging in high leverage trading, it is essential that you use sound risk management and assess your financial readiness and trading experience.

Are there hidden fees with Exness Standard Accounts?

Exness Standard Accounts are transparent about all costs, including spreads and commissions, ensuring traders can manage their funds without surprises.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.