Exness Fees

Exness offers competitive fees to give traders an affordable way of trading. Companied with low spreads, no hidden charges, transparent costs, Exness has grown to be preferred by traders worldwide.

Exness has different types of accounts with varying fee structures to suit all trading styles. It charges low spreads on major currency pairs and also zero-spread accounts that come with a small commission per trade. No hidden fees are involved. It’s all completely transparent. Moreover, Exness provides free deposits and withdrawals in that it covers most of the transaction fees regarding payment methods. Overnight positions might attract swap fees. Then again, in other respects, the brokerage firm does provide swap-free accounts for specific regions. From keeping costs low to keeping them clear—the steps Exness will take to ensure traders can maximize profitability.

Types of Fees on Exness

Exness has varieties of trading accounts, and with these accounts comes a fee structure. Knowing this will help in trying to keep your trading costs at a minimum.

Commission Fees on Exness

| Fee Type | Description |

| Spread Fees | The difference between the bid and ask price of an asset. |

| Commission Fees | Charged on some account types per lot traded. |

| Overnight Fees | Fees for holding positions overnight, also known as swaps. |

| Deposit/Withdrawal Fees | Generally free, but can vary by payment method. |

| Inactivity Fees | Fees for accounts that remain inactive for a long period. |

Understanding Spread Fees on Exness

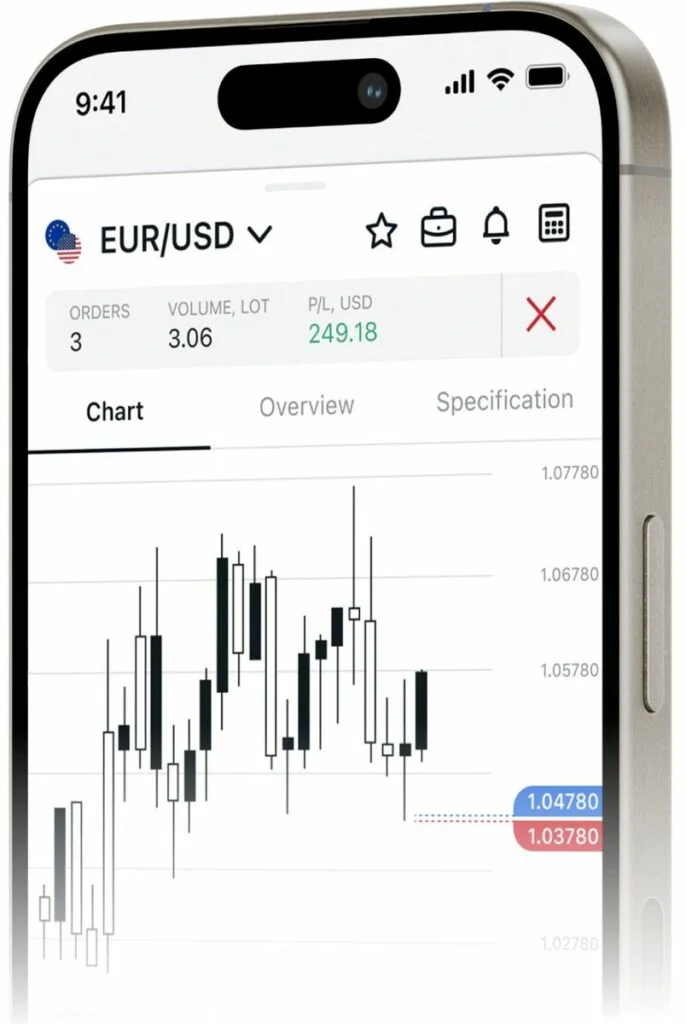

Spread fees are the most common type of fee you’ll encounter on Exness. They represent the difference between the bid and the ask prices of a trading instrument. Major currency pairs like EUR/USD generally have tighter spreads that make them cost-effective for trading frequently.

The spreads may change with respect to market conditions, type of account, and traded instrument. For example, London and New York sessions are times of maximum liquidity; the spreads are tighter. Spreads will get wider during times of low liquidity or high volatility.

Exness has both fixed and variable spreads. In the former, the cost is predictable and does not fluctuate with market conditions. Variable spreads, on the other hand, will see their prices drop lower according to market conditions in stable markets.

Commission Fees on Exness

Some account types in Exness have commission fees, especially those with very tight spreads.

- Raw Spread Accounts: These accounts come with spreads as low as 0.0 pips and come with a commission that is charged per lot traded.

- Zero Accounts: Accounts at this rate would also have a pips from 0.0 with a plus commission per lot. Knowing how the commission is charged is important in calculating your total cost of trading.

Overnight (Swap) Fees

You will be charged overnight fees, otherwise known as swap fees, when you hold your position overnight.

- Long Swap: Charged to your account when you have kept on buy position overnight.

- Short Swap: You will also have the charge if, on the other hand, you have kept the Sell position overnight.

- Swap-Free Accounts: In certain regions, traders are given swap-free accounts to save them from the burden of overnight fees. Furthermore, the fees can vary with each asset and depending on the prevailing market conditions.

Over 2 million people worldwide have chosen a global leader in online financial trading & investment.

Deposit and Withdrawal Fees on Exness

Exness does not charge any fee for either depositing or withdrawal of funds. This makes it very convenient for traders to transfer their funds in and out of Exness’ platform without an added cost. Most of its payment methods are free. This also include bank transfers, credit cards, and e-wallets. Truthfully speaking, this depends on the basis that ‘Exness won’t charge’, as what your payment provider might be charging is best known to them.

Exness covers most transaction fees, ensuring that you really get the most out of your trading capital. This feature is especially useful when you are one of those traders who have to frequently move funds around.

Specific payment methods may include their own fees. Always check the conditions of the applied method to avoid unexpected charges. Exness also provides instant withdrawals for many ways, allowing access to your money quickly.

Inactivity Fees

Exness charges inactivity fees when the account has been inactive for a longer time. This is for coverage against the costs incurred in upkeep for accounts that are inactive. Here’s how this works:

- Monthly Fee: A monthly fee is charged after 12 months of inactivity.

- Notification: You will be notified before any inactivity fee is charged.

- Reactivation: The inactivity fee will be stopped once you get back to trading or do any kind of activity on your account.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Strategies for Minimizing Trading Fees on Exness

You can avoid these fees by keeping your trading account active or in good standing.

Various Ways of Reducing Trading Fees on Exness

- Choose the Right Account: Select an account that would suit your volume and strategy of trading to help reduce the expenditure of spreads and commissions.

- Make Trades During High Liquidity: Make trades only at the peak sessions of the market, which are basically the London and New York markets. This is the time when greatest conditions in terms of spread prevail.

- Keep an Eye on Swap Rates: Be aware of overnight swap fees; if needed, use swap-free accounts if it fits your style of trading. Apply low-cost deposit and withdrawal options. Avoid inactivity fees by logging in from time to time and executing at least one trade or transaction.

- Time trades: Attempt to avoid trading during major news events where the spread could widen due to its volatility. Use Exness promotions When available, be on the lookout for any sort of promotion or discount from Exness to lower trading costs.

FAQs

Are there any hidden fees on Exness?

No, Exness is transparent about its fees. There are no hidden fees, but be aware of standard trading costs like spreads, commissions, and swap fees.

How can I see all fees associated with my account?

You can view all fees in your account dashboard on the Exness platform. Detailed fee information is available under the trading conditions section and your account statement.

Do Exness fees vary depending on the asset traded?

Yes, fees such as spreads and swap rates vary depending on the asset traded. Major currency pairs generally have lower spreads compared to exotic pairs or cryptocurrencies.

Are there any discounts or promotions available for reducing fees?

Exness occasionally offers promotions or discounts that can help reduce trading fees. Check the Exness website or your account dashboard for current offers.

How do I calculate the total cost of a trade on Exness?

To calculate the total cost of a trade, consider the spread, any applicable commission per lot, and swap fees if you hold positions overnight. Use the trading calculator on the Exness platform for precise calculations.

Can I negotiate lower fees with Exness?

Exness does not typically offer fee negotiations, but choosing the right account type and trading during high liquidity periods can help reduce costs.

What are the most cost-effective trading strategies to minimize fees?

To minimize fees, trade during high liquidity periods, use account types with lower spreads or commissions, and avoid holding positions overnight to reduce swap fees. Regularly monitor your account to stay updated on any changes in fee structures.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.