Exness Investment Calculator

The Exness Investment Calculator is an online tool that provides traders with a precise evaluation of the possible outcomes of their trading plans, helping them to weigh the pros and cons of different strategies, make smart choices and enhance their investment performance.

What is the Exness Investment Calculator?

The Exness Investment Calculator is an online tool that helps traders and investors to estimate the possible results of their trading plans. Created by Exness, a top global forex broker, this calculator offers a detailed assessment of different aspects that affect trading performance, such as leverage, position size, spreads, commissions, and swap rates.

Important Highlights of the Exness Calculator

A number of potent features are available in the Exness Investment Calculator to help traders assess and improve their trading tactics.

Understanding Profit and Risk

The Exness Investment Calculator’s capacity to precisely evaluate the possible profit and risk connected with a particular trading position is one of its main advantages. Traders can ascertain the possible profits or losses linked to a trade promptly by entering pertinent criteria including the entry price, stop-loss, and take-profit levels. Traders are better equipped to manage their risk exposure and make well-informed decisions thanks to this invaluable knowledge.

The calculator considers multiple aspects that can influence trading results, including leverage, position size, and market circumstances. The program offers a thorough examination of these elements, allowing traders to grasp the possible consequences of their trading choices.

Personalized Investment Scenarios

The Exness Calculator provides many customization options for users to adjust the tool according to their individual trading habits and account details. Traders have a variety of trading instruments to pick from, including as main and minor currency pairings, cryptocurrencies, stocks, and commodities. Furthermore, users have the option to choose their desired account type, leverage, and account currency to ensure precise calculations that match their trading conditions.

Utilizing the Exness Calculator

Traders need to follow specific measures to get the most of the Exness Margin Calculator and ensure precise computations.

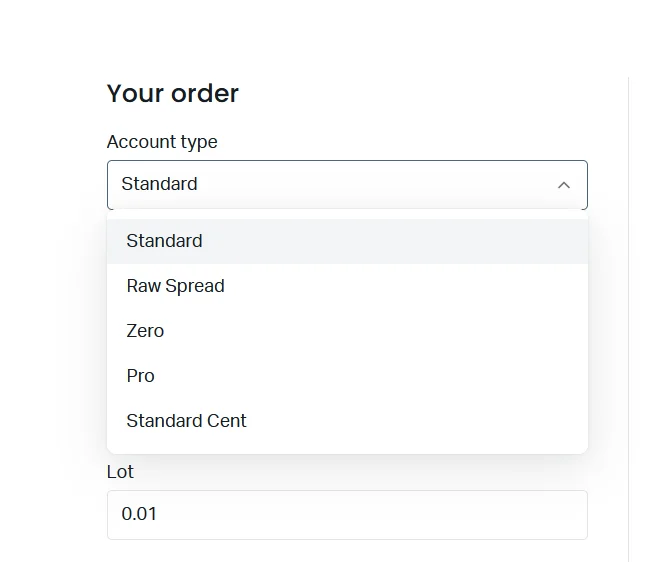

Picking the Right Account and Market

Traders need to choose the suitable account type and trading instrument before utilizing the Exness Investment Calculator. Initiating this stage is essential as it establishes the groundwork for precise computations and customizes the tool to the trader’s individual requirements.

Traders have the option to choose from many account types when making their selection.

- Standard account (Standard, Standard Cent)

- Account types for professionals include Raw Spread, Zero, and Pro.

Each account type has distinct characteristics and prerequisites, tailored to various trading preferences and methods.

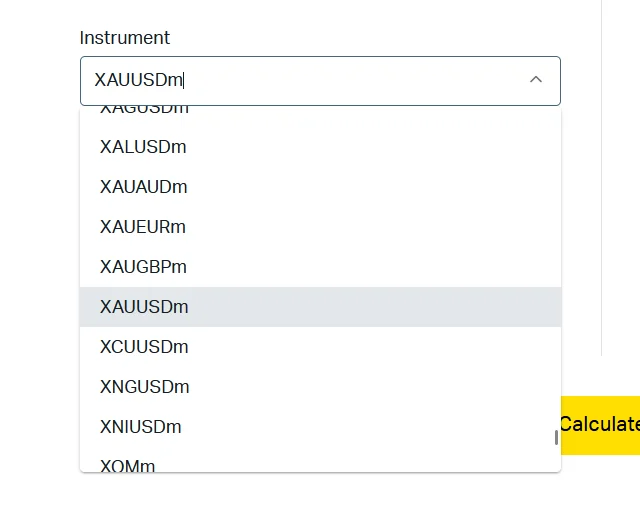

Traders must then choose the particular trading instrument they want to investigate. The Exness Investment Calculator accommodates various instruments.

- Forex pairs (major, minor, and exotic)

- Stocks

- Goods like oil or gold

- Digital coins (cryptocurrencies)

Traders can customize calculations to match the unique market conditions and attributes of their chosen asset by choosing the right trading instrument.

Entering Position Size, Entry Price, and Leverage

Traders need to submit the required parameters for their trade after choosing the account type and trading instrument. This involves determining the position size (in lots or units), the entry price for opening the trade, and the desired leverage ratio. Precise input of these variables is essential for getting dependable computations and risk evaluations.

Selecting Account Currency

Traders can choose their desired account currencies using the Exness Margin Calculator. This function is especially beneficial for traders who operate in many locations or those who wish to examine their operations in a particular currency. The calculator can provide precise figures that match the trader’s financial perspective by choosing the correct account currency.

Over 2 million people worldwide have chosen a global leader in online financial trading & investment.

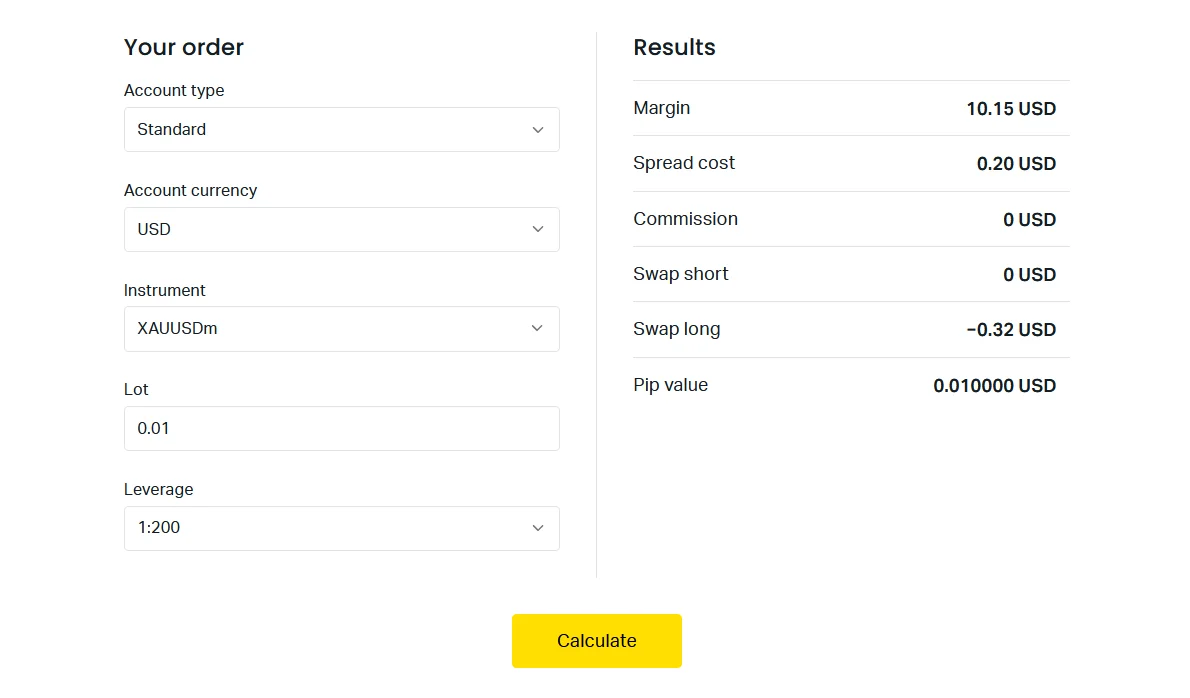

Analyzing the Results

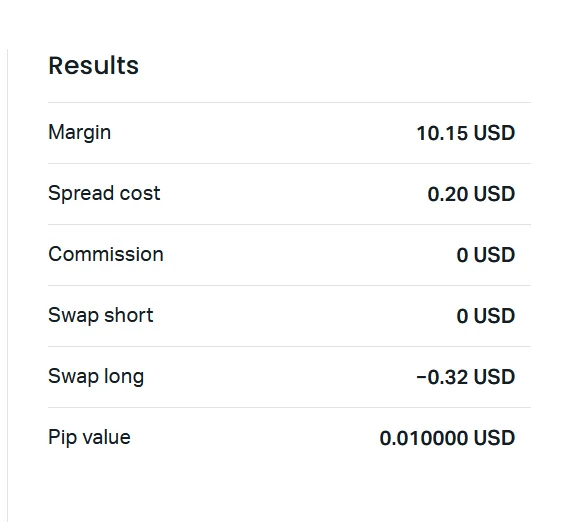

Once the required information is entered, the Exness Calculator produces detailed outcomes to help traders assess their trading tactics.

Understanding Margin and Leverage

The calculator shows the margin requirements for a certain trade, considering the leverage ratio and position size. Traders must have this information to guarantee they have enough funds in their account to sustain their positions and prevent margin calls.

Calculating Costs: Spread and Commissions

The Exness Investment Calculator offers a comprehensive analysis of the spread cost and any relevant charges linked to the deal. Traders use this information to evaluate the whole cost of implementing their strategies and incorporate it into their risk management and profitability assessments. The calculator usually shows:

- Spread Cost: The price difference for your trading asset, which affects your entry and exit cost.

- Commissions: Extra charges from your broker, varying by account type or trade volume.

Traders can make well-informed decisions about their trading methods, anticipate expenses, and precisely quantify prospective gains or losses by comprehending these costs.

Estimating Swaps and Holding Fees

The Exness Investment Calculator offers an approximation of the swap charges or position holding fees for deals kept overnight or for extended durations. This knowledge allows traders to make well-informed decisions regarding the possible expenses of holding their positions and to plan their exit strategies accordingly.

Pip Value and Its Impact

The Exness Investment Calculator shows the pip value for the chosen trading instrument. This figure signifies the financial amount linked to a single pip change in the price of the instrument, enabling traders to precisely estimate their prospective gains or losses depending on the expected price changes. The standard presentation of the pip value is as follows:

- Pip Value: The cash value of a one-pip move, which varies based on your trade size and currency.

- Potential Profit/Loss: An estimate of what you might gain or lose from pip movements.

Traders can assess the risk-reward ratio of their trades and make informed judgments regarding position sizing and risk management techniques by comprehending the pip value.

Exness Calculator Over Traditional Calculation Methods

The Exness Margin Calculator offers traders a higher level of simplicity, precision, and variety compared to traditional techniques for evaluating potential rewards, risks, and costs connected with trading. The Exness Calculator provides an efficient and error-free solution, unlike human calculations or spreadsheets, which are time-consuming and error-prone.

The Exness Calculator offers a user-friendly interface as one of its main benefits. Traders can input their chosen criteria with a few clicks and receive a full report quickly. This user-friendly interface not only saves time but also minimizes the probability of errors that may arise during manual computations.

Furthermore, a plethora of variables that can affect trading results are considered by the Exness Calculator, including leverage, position size, spreads, commissions, and swap rates. The calculator offers a more precise and comprehensive picture of the possible risks and rewards connected with a trade by taking into account each of these factors. In older methods, this level of detail is frequently disregarded or oversimplified, which could result in errors or oversights.

The Exness Calculator can handle a wide range of trading instruments, including foreign currency pairs, equities, commodities, and cryptocurrencies. Traders may assess their whole portfolio using one platform, reducing the necessity for different tools or calculations due to its adaptability.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Leveraging the Exness Calculator for Trading Strategies

The Exness Investment Calculator has many advantages that can be easily included into your overall investment strategy.

Incorporating the Exness Investment Calculator into your trading strategy not only aids in decision-making but also plays a critical role in risk management and portfolio optimization. It’s about making smarter choices that align with your investment goals for enhanced performance in the trading world.

FAQ

What is the optimal leverage for a $10 account on Exness?

When dealing with a $10 account, it is recommended to utilize lower leverage ratios such as 1:100 or 1:200 to reduce the chances of a margin call or depletion of the account.

How is profit calculated in Exness?

When calculating profit, take into account the trade size, entry and exit prices, spread, commission fees (if applicable), and swap rates for overnight positions. The Exness Calculator streamlines this process by offering the prospective profit or loss.

What is the Exness Trading Calculator?

Exness offers an online tool that enables traders to evaluate the possible risks and benefits of their strategies by entering factors such as instrument, position size, price, leverage, and currency.

Is a leverage ratio of 1:500 (5x) appropriate for the majority of trading accounts?

A leverage of 1:500 (5x) is typically viewed as high-risk and not recommended for the majority of traders, particularly novices or individuals with lesser risk tolerance.

How can I utilize the Exness Calculator?

Choose the account type, trading instrument, position size, entry price, leverage, and currency. The calculator will produce outcomes such as margin requirements, profit/loss, costs, and pip values.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.